HappyPax.com

Drivers: If you are an independent, part time or volunteer driver you may need to be keeping track of your daily mileage or expenses to get reimbursed.

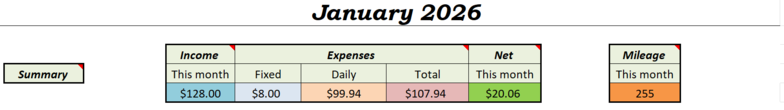

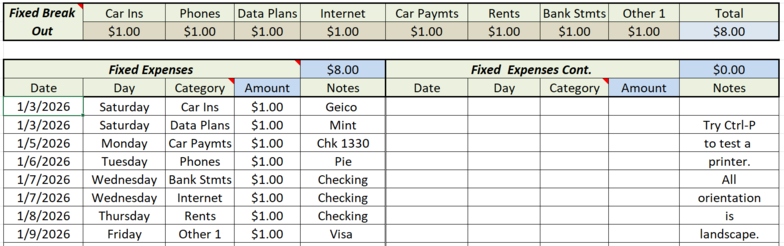

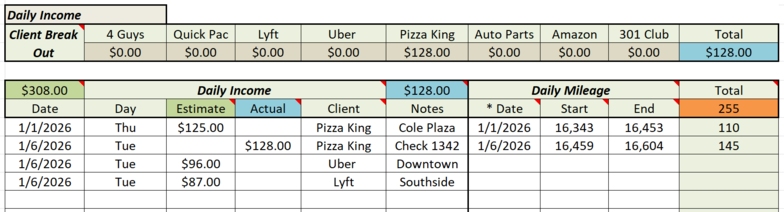

If you are self-employed you need to keep accurate records of your daily driving mileage, income and expenses.

For the independent, at the end of the year, you are required to pay taxes on your driving income. You can protect that income by keeping your receipts and recording them in this small software tool. Simply select the month, enter your spending, mileage and estimated income for the day. That's it! Everything is totaled automatically for the year.

A tool for drivers.

Try before you Buy: Here is a free version to try before you buy. It's an Excel workbook (spreadsheet). Simply click free download and open from your downloads folder. Watch the training video to learn how easy it is to use and how valuable it will be all year. The best news, the workbook cost less than a tank of fuel.

Courier, DoorDash, Lyft, Uber, Amazon, Bags, FedEx, Limo, Fur, Taxi, Parts, CDL, Lab, Document, Package, Pizza, Medical, Last mile deliveries ...

Bundle

2026

2025

2026

&

2025

$74

20%

$59

Actual cost and daily receipt totals make a big difference in protecting your net income.

Value

Save

$49

$25

The Buy Now button will take you to a payment processor. You do not need an account to make the payment. Scroll to select your payment preference. Pay as a guest for Debit or Credit Card or join PayPal. The link is designed to protect your personal information. This web site cannot see or capture any of your payment processing. That works great as we have no interest in your personal transactions. Your payment is totally secure. They process millions of transactions every day. For your purchase you will be prompted for your card information and for the address information that matches up with your card. Provide your email address. That is where you get a purchase receipt. Click off the save information option, to continue checkout as a guest.

Per your successful payment you will be sent to a page where you can immediately download your workbook(s).

Required - To use the workbook it needs Microsoft Excel or equivalent

Click a Buy Now button ... expect a slight delay

Click and expect a slight delay

Most popular ------->

Year

Learn more ... free download!

Learn more ... need a copy of Excel?

Take a look ----------->

Click and expect a slight delay

Sample ------->